Click here to download Minco’s Half-Year Report 2021. (PDF)

Minco Exploration PLC

Interim Report for the six months ended 30 June 2021

Highlights

– Two drill holes completed on Navan and Kells targets

– Drilling underway on Moate Prospecting Licence

– Drilling planned on Slieve Dart, Galway, licence block

COMPANY OVERVIEW

Minco Exploration plc (“Minco”) holds Prospecting Licences in Ireland which are highly prospective for the discovery of zinc-lead mineralisation. The Licences are operated by Minco’s wholly owned subsidiaries, either alone or in joint venture with Boliden – Tara Mines (“Boliden”).

Minco (20%) is participating in a joint venture with Boliden (80%) on Licence 1440R Navan (Tatestown), which lies immediately adjacent to Boliden’s large 130 million tonnes Tara zinc-lead mine at Navan.

Minco is also participating in a joint venture with Boliden on Licence 3373 (Kells), contiguous to the west of Licence 1440R, where Minco can earn up to a 75% interest; and in a joint venture with Boliden on ten Prospecting Licences in County Galway (Slieve Dart) where Minco can earn up to a 50% interest.

Minco also holds a 100% interest in two Licences at Moate, County Westmeath, where drilling is currently underway.

MANAGEMENT REPORT

When Minco Exploration PLC was spun out by Buchans Resources to its shareholders at the end of 2019, and introduced to new shareholders in February 2020, little did we know the difficult circumstances that would face us within just a short few weeks. The Covid pandemic impacted on all our plans and, in compliance with Government guidelines to help limit the spread of the virus, Minco initially suspended all field activities.

Minco’s planned exploration programs included drill testing high priority targets, up-grading existing targets, and continuing to develop new targets through field work and data interpretation. The schedule and timelines for these programs were delayed because of the COVID-19 pandemic.

Nevertheless, Minco Exploration is moving forward. With the lifting of restrictions, drilling is currently underway on Minco’s wholly owned Moate licence in County Westmeath, and thanks to the safe working practices developed by our joint venture partner, Boliden, we were able to drill test two targets on our prospecting licences in the Navan area in the first half of 2021.

Notwithstanding the ongoing COVID-19 pandemic, we believe that the medium to long term demand for metals is increasing and the principal reason for the positive outlook is the growing recognition that metals and minerals are essential for addressing climate change and adapting to a green economy.

EXPLORATION UPDATE

Navan (Tatestown) (20% interest)

Minco (20%) is participating in a joint venture with Boliden (80%) on Licence 1440R (Tatestown) just to the north-east of the Tara Mine. This licence has numerous targets similar in scale to the small Tatestown Prospect which was discovered in the 1970’s. Because of the proximity to the Tara Mine and its infrastructure, the size of mineral deposit required to make an economic discovery here is much smaller than it would be in a greenfield setting.

During the period a single drill hole was completed to test a target selected based on a combination of previous positive results, interpretation of a seismic survey and prospective geology. The drilling results supported the geological interpretation but indicated that the target is dismembered into a series of sub-economic slices by several faults.

The expenditure maintains Minco’s 20% interest in the licence and is sufficient to hold the licence at the next renewal in October. In conjunction with Boliden, Minco will go forward next year with a systematic program of drill testing further targets within this highly prospective and strategically located licence.

Kells (25% interest, with option to earn 75%)

Minco has an option from Boliden to earn a 75% interest in PL 3373. about 15km to the west of the Tara Mine. The historic seismic data for this area was reviewed in conjunction with our joint venture partner, Boliden, given the significant advances in the processing and interpretation of seismic data. This review of the historic exploration data highlighted four targets within the licence in rocks located at depths in the order of 500 – 800m, similar to those that host the Tara orebody, where drill testing is warranted.

During the past six months Minco drill tested the first of those targets. The drill hole confirmed the interpretation of the geology but, unfortunately, there was no significant mineralisation encountered. Minco has increased its interest in the licence to 50% and we are now assessing the results of this 2021 drill hole with the intention to test the next target in 2022, which upon completion will increase Minco’s interest in the licence to 75%.

Slieve Dart (40% interest, with option to earn 50%)

The other important area where we are operating with Boliden Tara Mines is the 447km2 Slieve Dart block in County Galway, considered one of the orphans of Irish exploration. Back in the 1970’s and ‘80’s exploration by predecessor companies of Minco, and others, discovered numerous small concentrations of mineralisation to the north-east of Tuam. However, the discoveries of the Galmoy and Lisheen mines in the 1990’s diverted attention and it was not until recent years that focus was again directed back to this Slieve Dart area, this time by Boliden.

The early results from Boliden’s work resulted in the discovery of further small mineral occurrences. However, more importantly, it was recognised that there were some major structures extending through the area that could provide the plumbing system for bigger concentrations to depth.

At the same time Boliden’s discovery of the Tara Deep deposit, using a combination of good geology, adapting seismic survey techniques used in oil exploration, and a commitment to drilling, highlighted the way forward for exploration in the Slieve Dart area.

Minco was invited to join Boliden in this program and has an option to earn a 50% interest in the 10 licence Slieve Dart licence block.

In late 2019, in conjunction with Boliden and the Geological Survey of Ireland, Minco funded a seismic survey across the Slieve Dart area. Interpretation of the results of that survey during the past year has supported the interpretation of a major structural plumbing system hidden beneath the cover rocks.

The next step will be to drill test along the line of the seismic survey to validate the interpretation. Minco is planning to put the building blocks in place for a multi-year exploration strategy for the Slieve Dart area. Ongoing geological assessment continues on target selection with the intention to undertake a drilling program in 2022.

Moate Block (100% interest)

The other area where we are progressing is in our 100% owned Moate licence block. where the target is a Tynagh Mine type deposit (11.8 Mt @ 11.5% Zn+Pb) and where a target has been defined to the east of Athlone which is considered analogous to the zinc-lead mineralised zones at the former Tynagh mine, 45 km to the south-west, and the smaller Ballinalack deposit to the east.

The target was defined following a detailed review of historic exploration results and more recent drilling by Minco. Covid restrictions delayed drill testing, however, following the recent relaxation in restrictions, diamond drilling has started at the end of August 2021.

OUTLOOK

Looking to the future, notwithstanding all the COVID-19 relates issues, and unexpected delays of the past year we have not lost focus on our objectives. We remain very excited about the future prospects for Minco and its exploration targets. We believe that the medium to long term demand for metals is growing, particularly in the non-carbon electric economy and the fundamental outlook for all base metals, including zinc, remains very strong.

The International Energy Agency (IEA), in its May 2021 report, The Role of Critical Minerals in Clean Energy Transitions, states that the rapid deployment of clean energy technologies as part of energy transitions implies a significant increase in demand for minerals. Solar photovoltaic plants, wind farms, and battery-electric vehicles (BEVs) generally require more minerals to build than their fossil fuel-based counterparts. A typical electric car requires six times the mineral inputs of a conventional car and an onshore wind plant requires nine times more mineral resources than a gas-fired plant.

To-day people are looking to the post-Covid future and governments globally are assessing their investment strategies. As the world recovers from the pandemic, trillions of dollars are being invested to rebuild infrastructure as well as transitioning to a green economy. Governments around the world are launching huge stimulus programmes focused on job creation and environmental stability, leading to the potential for a multi-decade commodity cycle ahead driven by decarbonisation of the global economy and shift to cleaner energy. Metals are essential for electrification, copper for power generation, transmission and energy storage, zinc for extending the lifespan of products, and lead for energy storage.

Many of these strategies will be focussed on achieving a carbon-neutral future within the next few decades, which will mean long term demand and support for critical and strategic minerals, including in particular copper, and indeed lead and zinc. The simple fact, recognised by the European Commission, the World Bank, the United Nations and others, is that getting to that end result means that mineral production will have to increase significantly, and not just lithium and rare earths which are highlighted in the popular press, but the basics – zinc and copper.

That increase in metal production will need new mines and without exploration there will be no new mines to meet that projected demand.

Minco intends to do its part, identify ground that we believe is prospective for discovery of new orebodies in Ireland., define specific targets within those areas and then drill test those targets.

MINCO EXPLORATION PLC

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED 30 JUNE 2021

Unaudited

Expressed in Euros, unless noted and per share amounts

- BASIS OF PREPARATION AND STATEMENT OF COMPLIANCE

Minco Exploration PLC (” Minco Exploration” or the “Company”) was incorporated in Ireland on 28 May 2019 as a wholly owned subsidiary of Buchans Resources Limited (“Buchans”) to acquire the shares and receivables in subsidiaries from Buchans, its parent company. At 31 December 2019 Buchans held all of the shares of the Company for distribution to its shareholders. On 31 December 2019, pursuant to a Plan of Arrangement, Buchans distributed to its shareholders 59,868,716 exchangeable warrants (“Exchangeable Warrants”) entitling shareholders to receive either one share of Minco Exploration or 0.25 additional shares of Buchans, at the shareholder’s option, for each share of Buchans held. During the year 2020, 1,039,844 Exchangeable Warrants were exchanged into Minco Exploration shares, 9,079,000 Exchangeable Warrants were exchanged into 2,269,744 Buchans shares, and 185,152 Exchangeable Warrants were cancelled. On 31 December 2020 the remaining 49,564,720 unexercised Exchangeable Warrants were automatically exchanged into Minco Exploration shares. See Note 2 to the 31 December 2019 consolidated financial statements.

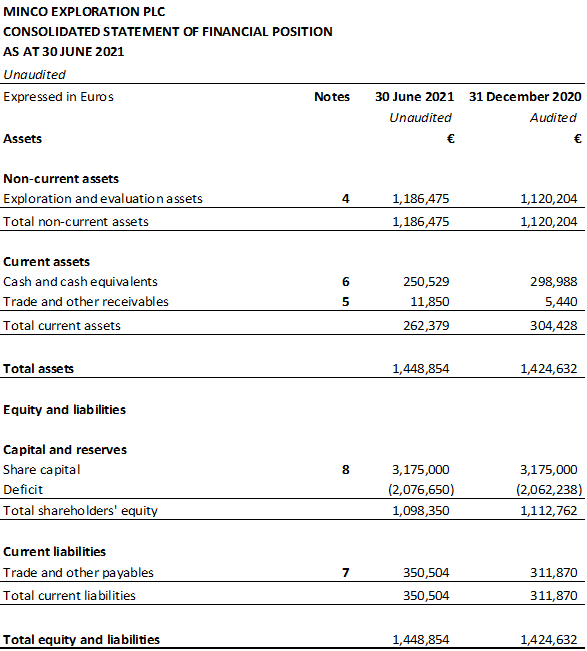

The interim financial statements for the six months ended 30 June 2021 and the comparative amounts for the six months ended 30 June 2020 have not been audited or reviewed by the auditors of the Group.

The interim financial statements have been prepared in accordance with IAS 34 Interim Financial Reporting as adopted by the European Union. The interim financial statements have been prepared applying the accounting policies and methods of computation used in the preparation of the published consolidated financial statements for the year ended 31 December 2020.

The interim financial statements do not include all of the information required for full annual financial statements and should be read in conjunction with the audited consolidated financial statements of the Group for the year ended 31 December 2020, which are available on the Company’s website.

No dividend is proposed in respect of the period

- RELATED PARTY TRANSACTIONS

Group

Transactions between the Company and its subsidiaries, which are related parties, have been eliminated on consolidation and are not disclosed for the Group but are disclosed below for the Company.

Amounts are advanced from the Company to subsidiary companies to finance exploration and evaluation costs and other operating expenses. These amounts are unsecured, non-interest bearing and repayable on demand.

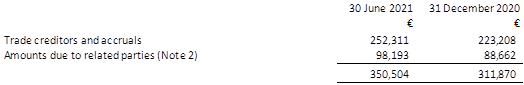

At 30 June 2021, the Company accrued €98,193 (31 December 2020 – €88,662) payable to Buchans covering administration costs and services.

The subsidiaries of the Company at 30 June 2021 were as follows:

| Name of Company | Registered or Head office | Effective Holding | Principal Activity |

| Norsub Limited | 18-20 Le Pollet, St. Peter Port, Guernsey, GY1 1WH | 100% | Holding company |

| Minco Ireland Limited

Westland Exploration Limited Minco Mining Limited |

Ardbraccan, Navan, Co. Meath, Ireland

Ardbraccan, Navan, Co. Meath, Ireland 9 Little Trinity Lane, London EC4V 2AN |

100%

100% 100% |

Exploration

Exploration Exploration |

Remuneration of key management personnel

No fees were paid by the Company to directors for their services as directors of the Company in the periods ended 30 June 2021 and 2020.

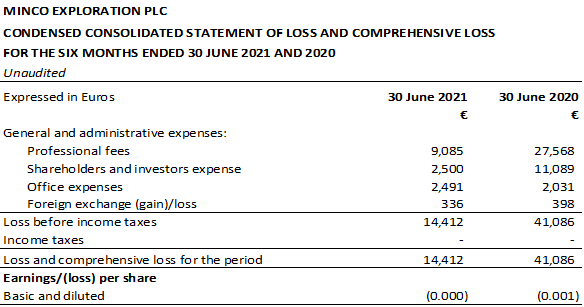

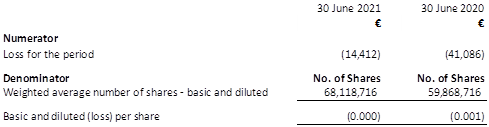

- EARNINGS / (LOSS) PER SHARE

Basic loss per share is computed by dividing the loss after taxation for the period available to ordinary shareholders by the sum of the weighted average number of ordinary shares in issue and ranking for dividend during the period. Diluted loss per share is computed by dividing the loss after taxation for the period by the weighted average number of ordinary shares in issue, adjusted for the effect of all potential dilutive ordinary shares that were outstanding during the period. Basic and diluted losses per share are the same, as the effect of the outstanding share options is anti-dilutive and is therefore excluded. The computation for basic and diluted loss per share is as follows:

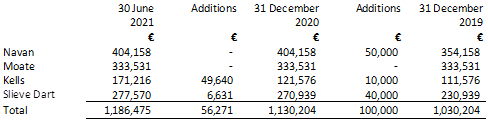

- EXPLORATION AND EVALUATION ASSETS

The realisation of the exploration and evaluation assets is dependent on the successful discovery and development of economic mineral deposits, including the ability to raise finance to develop the projects. Should this prove unsuccessful the value included in the statements of financial position for exploration and evaluation assets would be written off. The Directors are aware that by its nature there is an inherent uncertainty as to the value of the exploration and evaluation assets.

Ireland

The Company, through its wholly owned subsidiary, holds indirectly a 20% interest in Prospecting Licence 1440R (Navan/Tatestown), which is being explored under a Joint Venture agreement with Boliden Tara Mines DAC (80%), and which hosts part of the small Tatestown–Scallanstown zinc-lead mineral deposit, located adjacent to Boliden’s large Tara zinc-lead mine at Navan, County Meath, about 50 km northwest of Dublin.

The Company, through its wholly owned subsidiary Minco Ireland Limited, has entered into a joint venture agreement with Boliden Tara Mines on PL 3373, at Kells near Navan, County Meath, contiguous to the west with PL 1440R. Under the terms of this agreement, the Company can earn a 75% joint venture interest through expenditures of €250,000 in staged programmes, by March 2024. Boliden has the right of off-take to purchase or toll process all ore that may be produced from the license area.

The Company, through its wholly owned subsidiary Minco Ireland Limited, holds two Prospecting Licenses, 1228 and 1229, in County Westmeath, Ireland. Under the terms of these licences, Minco is required to spend a total of €150,000 in staged programmes, by March 1, 2024.

The Company, through its wholly owned subsidiary Minco Ireland Limited, has entered into a joint venture agreement with Boliden Tara Mines on ten licenses at Slieve Dart in County Galway. Minco can earn a 50% interest through expenditure of €385,000 in staged programmes, by 31 July 2024. Boliden has the right of off-take to purchase or toll process all ore that may be produced from the license area.

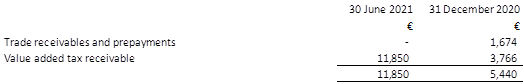

- TRADE AND OTHER RECEIVABLES

The carrying value of the receivables approximates to their fair value. In the opinion of the Directors, the amounts above are considered to be fully recoverable.

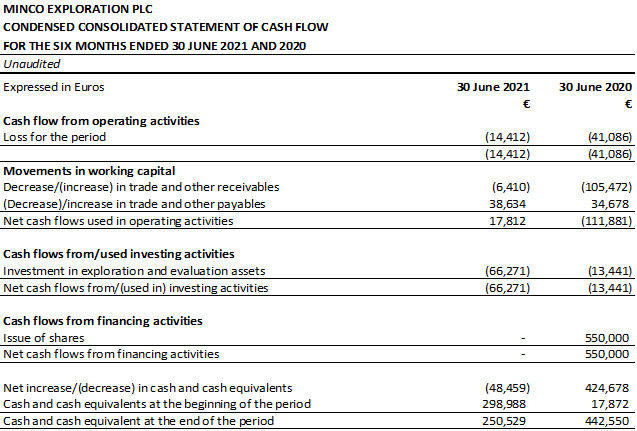

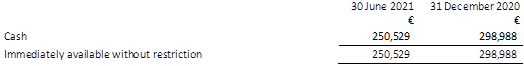

- CASH AND CASH EQUIVALENTS

Cash and cash equivalents comprise cash balances held for the purposes of meeting short-term cash commitments and investments which are readily convertible to a known amount of cash and are subject to an insignificant risk of change in value. Where investments are categorised as cash equivalents, the related balances have a maturity of three months or less from the date of investment. Cash at bank earns interest at floating rates based on daily bank deposit rates. Short-term deposits are made for varying periods of between one day and three months, depending on the cash requirements of the Company, and earn interest at the respective short-term deposit rates at floating rates.

- TRADE AND OTHER PAYABLES

It is the Group’s normal practice to agree terms of transactions, including payment terms, with suppliers and provided suppliers perform in accordance with the agreed terms, it is the Group’s policy that payment is made as they fall due. The carrying value of the trade creditors and accruals approximates to their fair value. The Group has financial risk management policies in place to ensure that all payables are paid within the credit timeframe. The amounts due to related parties are due on demand, unsecured and non-interest bearing.

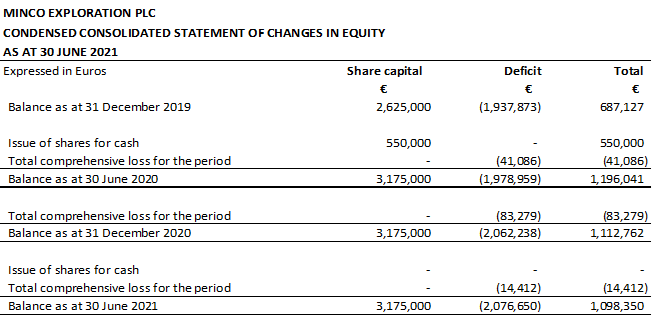

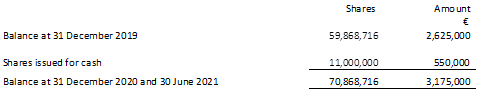

- SHARE CAPITAL

On 31 December 2019, pursuant to a Plan of Arrangement, Buchans Resources Limited distributed to its shareholders, 59,868,716 exchangeable warrants (“Exchangeable Warrants”) entitling shareholders to receive either one ordinary share of Minco Exploration or 0.25 additional shares of Buchans, at the shareholder’s option, for each share of Buchans held.

During 2020, the Company completed a private placement of 11,000,000 new ordinary shares at a price of €0.05 per share, to raise a total of €550,000 to fund its working capital and planned exploration programs.

During the year 2020, 1,039,844 Exchangeable Warrants were exchanged into Minco Exploration shares, 9,079,000 Exchangeable Warrants were exchanged into 2,269,744 Buchans shares, and 185,152 Exchangeable Warrants were cancelled. On 31 December 2020 the remaining 49,564,720 unexercised Exchangeable Warrants were automatically exchanged into Minco Exploration shares and the holders automatically became shareholders in the Company.

At 31 December 2020 and 30 June 2021, Buchans held 9,264,152 shares of the Company.

Enquiries:

Minco Exploration PLC

John Kearney, Chairman +1 (416) 362 6686

Peter McParland, Chief Executive +353 (0) 4690 73709

www.MincoExploration.com

This news release may include certain “forward-looking statements”. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding potential mineralization, resources and reserves, exploration results, and future plans and objectives of Minco Exploration, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Minco Exploration’s expectations are exploration risks detailed herein and from time to time in the filings made by Minco Exploration with securities regulators.

Recent Comments